Food Manufacturing Insurance

What Is Food Manufacturing Insurance?

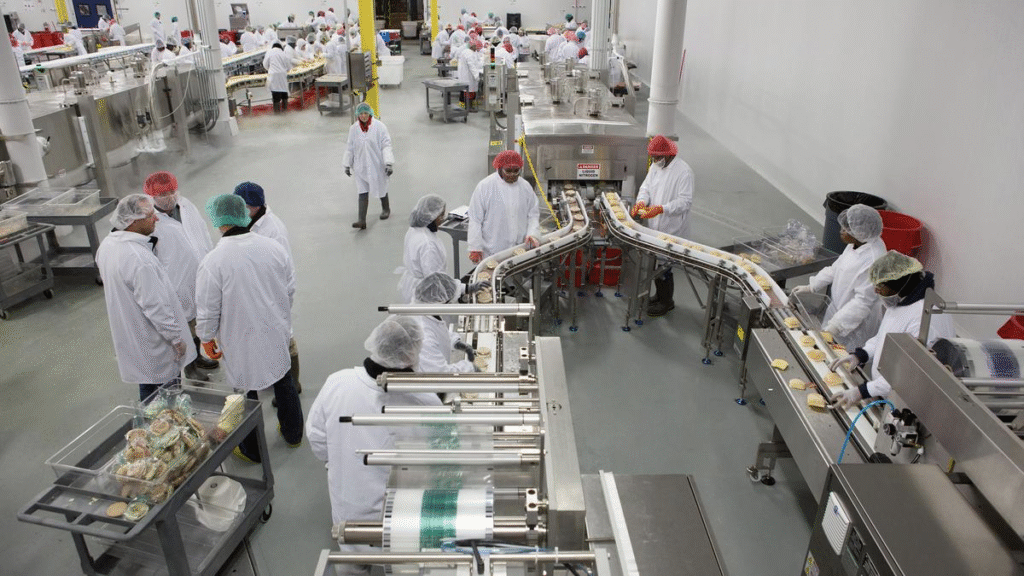

Food manufacturing insurance is a specialized form of business insurance designed to protect food production companies from financial losses due to third-party injury, property damage, and other operational risks. This coverage is essential for businesses involved in processing, packaging, or distributing food products.

Why Do You Need Food Manufacturing Insurance?

In the food manufacturing industry, there are several daily risks that could lead to costly lawsuits or business disruptions. A comprehensive food manufacturer insurance policy helps safeguard your company from:

Employee injuries on the production floor or during equipment handling

Machinery and equipment breakdowns, which can halt production

Theft or loss of inventory, raw materials, or tools

Supply chain interruptions, which can delay orders and impact revenue

Whether you’re operating a small commercial kitchen or a large-scale food factory, having the right food processing insurance is critical for business continuity, compliance, and peace of mind.

Who Needs Food Manufacturing Insurance?

Food manufacturing insurance is essential for businesses involved in the production, processing, or packaging of food and beverages. If your business operates in any of the following areas, you need this type of specialized coverage:

Meat processing plants – Protect against contamination, equipment failure, and liability claims.

Commercial bakeries – Coverage for property damage, product recalls, and customer injury.

Dairy product manufacturers – Insurance for spoilage, supply chain issues, and general liability.

Canned food manufacturers – Safeguard your production line and protect against food safety claims.

Beverage producers – Covers risks related to packaging, labeling errors, and distribution liabilities.

If you’re in the food and beverage industry, having the right food manufacturer insurance is critical to protect your operations, equipment, and brand reputation.

Common Risks in the Food Manufacturing Industry

The food manufacturing industry faces a wide range of unique and specialized risks that can disrupt operations and impact profitability. Whether you run a small processing plant or a large-scale production facility, it’s important to understand the potential exposures your business may face.

Some of the most common risks in food manufacturing include:

Food processing challenges such as contamination or equipment breakdown

Inventory risks with perishable goods that require strict temperature control

Logistical issues related to storing and transporting food products safely and efficiently

To maintain high food safety standards and meet quality assurance protocols, it’s crucial to proactively manage these risks. Investing in the right food manufacturing insurance coverage can help protect your business from financial losses due to recalls, liability claims, spoilage, or equipment failure.

Types of Food Manufacturer Insurance Coverage

Running a food manufacturing business involves complex operations, strict regulations, and high-risk exposure. That’s why having the right food manufacturer insurance is essential to protect your company from costly claims, product recalls, and business interruptions.

Here are the most common types of insurance for food manufacturers:

1. General Liability Insurance

This is the foundation of any food manufacturing insurance policy. It covers third-party bodily injury, property damage, and product liability claims. If a customer gets sick from a contaminated product or is injured due to your operations, this policy helps cover legal costs and settlements.

2. Product Liability Insurance

Product liability insurance is crucial in the food industry. It protects your business against claims related to contaminated, mislabeled, or defective food products. For food manufacturers, this is often one of the most important types of coverage.

3. Commercial Property Insurance

This coverage protects your manufacturing facility, warehouses, and equipment from risks such as fire, theft, or natural disasters. It’s essential for any food production company with physical assets.

4. Equipment Breakdown Insurance

Food manufacturing relies heavily on specialized machinery. Equipment breakdown insurance helps cover the cost of repairs or replacements if essential processing equipment fails, minimizing downtime and production loss.

5. Business Interruption Insurance

If your operations are halted due to a covered event (e.g., fire, flood, or equipment failure), business interruption insurance helps cover lost income and ongoing expenses until you’re back in business.

6. Workers’ Compensation Insurance

For food manufacturers with employees, workers’ comp insurance is legally required in most states. It provides medical benefits and wage replacement if workers are injured on the job.

7. Commercial Auto Insurance

If you use vehicles to distribute products or transport ingredients, commercial auto insurance protects against accidents, property damage, and liability related to business driving.

8. Food Contamination & Spoilage Insurance

This specialized policy helps recover losses if your inventory is spoiled due to power outages, equipment failure, or contamination. It’s critical for manufacturers working with perishable goods.

Protect Your Food Manufacturing Business

Each food manufacturer has unique risks. The right combination of food manufacturing insurance policies ensures full protection—from the production line to the consumer’s table. Speak with a specialized insurance provider to create a policy tailored to your operations.

Get Expert Help with Restaurant Insurance Coverage

If you’re looking for clear policy advice or a precise quote for business insurance for restaurants, our licensed specialists are here to help. We understand the unique risks involved in running a food business, and we’re committed to finding you the best protection at the most competitive rate.

Our team can often apply additional discounts of 10% to 15% on top of the instant quotes you receive—so don’t hesitate to contact us for a personalized review. Whether you own a small café or manage a full-scale kitchen, we offer tailored restaurant insurance programs to fit your needs.

Here’s what you can expect from us:

- Expert, licensed agents who understand business restaurant insurance

- Same-day coverage available in most cases

- Policies from A-rated insurance providers

- Nationwide coverage options

The best coverage at the lowest restaurant insurance cost

Protect your business today with the right insurance for a restaurant. From restaurant insurance California to general insurance restaurants and even businesses near Cross Insurance Arena, we’ve got you covered.

Get in Touch

Access resturent insurence anytime, anywhere.

Catering insurance is designed to protect your business from a range of common risks, including third-party injuries, property damage, foodborne illnesses, and employee injuries on the job. It can also be tailored to cover specific situations, such as alcohol-related incidents and employment practices liability.

Whether you’re looking for insurance for a restaurant, exploring restaurant insurance programs, or need business insurance for a restaurant in California, having the right coverage is essential. Our customized solutions ensure your business restaurant insurance meets your needs—especially if you’re located near busy areas like the Cross Insurance Arena.

Protect your business with trusted restaurant insurance in California that’s built for your operation. From small cafés to high-volume eateries, we provide reliable insurance restaurants can count on.

Catering insurance costs vary based on factors like location, coverage limits, and business size, with monthly premiums typically ranging from $50 to $600.

While insurance for a restaurant offers essential protection, it’s important to know its limits. Most restaurant insurance programs don’t cover equipment or products once they leave your main business location. Additionally, some policies may exclude certain employment-related claims.

Whether you’re searching for business insurance for a restaurant or evaluating your current restaurant insurance in California, take the time to thoroughly review your policy. Understanding these exclusions can help you choose the right business restaurant insurance plan for your needs.

If your restaurant operates near busy areas—like restaurants near Cross Insurance Arena—it’s even more important to make sure your insurance restaurants policy fits your risk exposure.

Selecting the right business insurance for your restaurant starts with understanding your unique risks. Whether you run a small catering service or a full-scale restaurant, it’s essential to compare multiple restaurant insurance programs and request detailed quotes. Be sure to carefully review each policy to understand coverage limits, exclusions, and how well they protect your operations.

If you’re located in California, choosing the right restaurant insurance California providers can ensure compliance and peace of mind. From business restaurant insurance to specialized insurance for restaurants near Cross Insurance Arena, the right plan can protect your staff, property, and reputation. Make an informed decision by weighing all options and choosing the best restaurant insurance tailored to your needs

Catering insurance costs vary based on factors like location, coverage limits, and business size, with monthly premiums typically ranging from $50 to $600.

Yes, you can absolutely enhance your existing catering insurance coverage to better protect your operations. Whether you’re a mobile caterer or operate from a fixed location, upgrading your policy ensures that your business is fully covered against evolving risks.

Many restaurant insurance programs offer customizable options that go beyond basic liability—this includes equipment protection, event-specific coverage, and employee injury protection. If you’re running a food service business in California, updating your restaurant insurance California plan can help you stay compliant with local regulations while reducing your exposure to financial loss.

Choosing the right business insurance for restaurant services means tailoring your coverage to fit your specific needs. Whether you’re catering events at venues like those near Cross Insurance Arena or serving daily meals from a restaurant, it’s crucial to have the right business restaurant insurance in place.

Talk to a provider that specializes in insurance for restaurants to review and enhance your policy. A well-rounded business insurance restaurant policy gives you peace of mind so you can focus on creating memorable dining experiences.